The role of RSS is to provide Singaporeans with a monthly income to support their daily living expenses during retirement.

To mitigate longevity risks, CPF LIFE Scheme was introduced.

*RSS and CPF LIFE are 2 different schemes.

Retirement account (RA)

RA is formed only when you reach the age of 55.

Funds from your SA are transferred to RA first, followed by OA .

The amount transferred depends on the full retirement sum at that point in time.

How it works:

Assume FRS is $176k at that point in time

Before age 55

OA : $100,000

SA: $100,000

MA: $57,200

After age 55

OA : $24,000

SA: $0

MA: $57,200

RA: $176,000

Basic/Full/Enhanced Retirement Sum

It is important to know the figures of BRS and FRS (2xBRS) , and whether you can satisfy them when you turn 55.

Satisfying your FRS would hence allow you to withdraw any excess from your OA & SA at age 55.

Conversely, the amount you could withdraw would be limited if FRS is not satisfied.

Though, if you pledge your house to CPF, one could withdraw the excess above BRS.

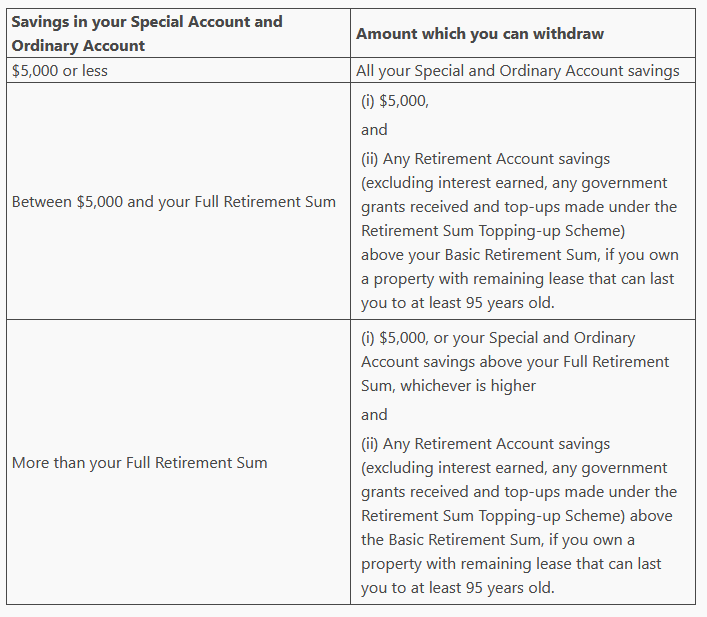

The table below shows how much you can withdraw after forming the RA.

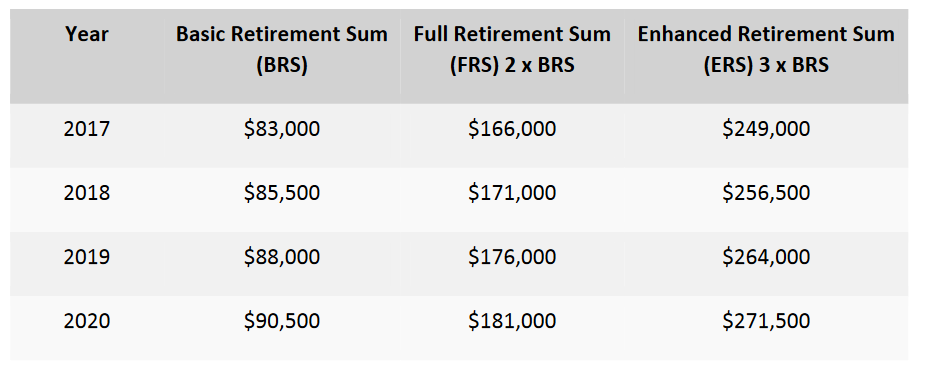

The table below shows the gradual increase of BRS,FRS and ERS over the years.

The BRS will not remain the same each year. It has been increasing at 3% from the cohort in the previous year to cater for long term inflation and increase in standard of living.

Conclusion

For the sake of freeing up your savings, it is important to satisfy the BRS/FRS. When planning for retirement, RSTU is a good way to do this, especially since SA earns a higher interest and let compounding works its magic.