What is CPF?

CPF is a mandatory saving scheme for all Singaporeans.

It is used to purchase a home, pay for medical bills and to be utilized for retirement.

Types of Accounts

Ordinary Account

Special Account

MediSave Account

Retirement Account (Created at age 55)

Accounts are created when first top-ups/contributions are first received.

How it Works

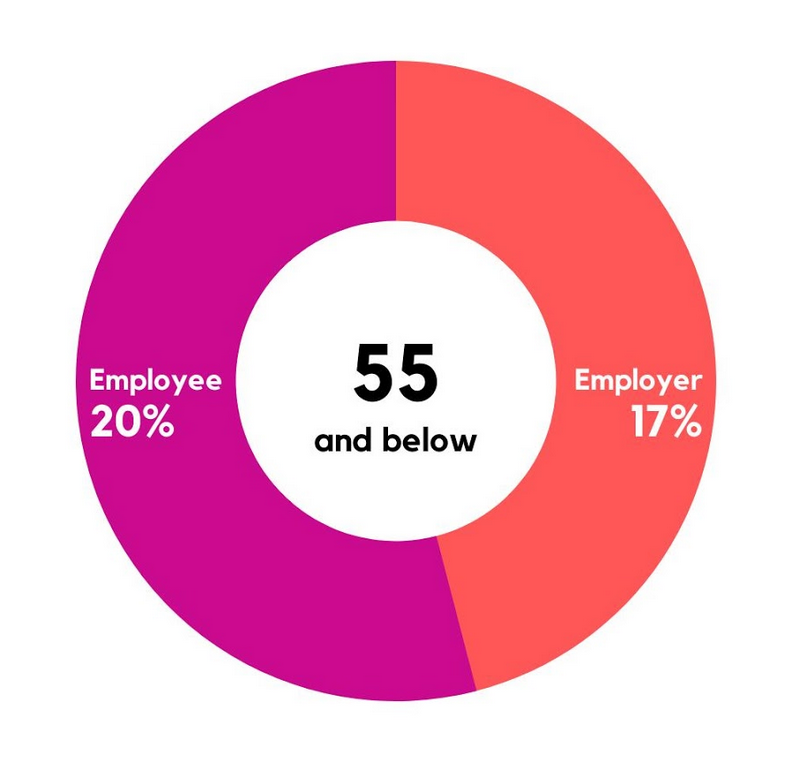

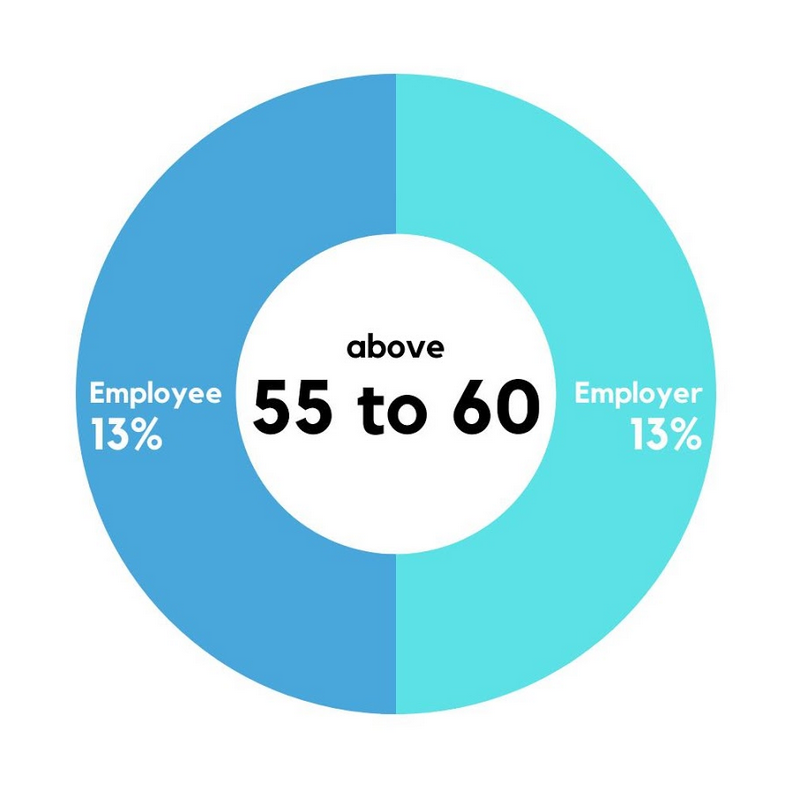

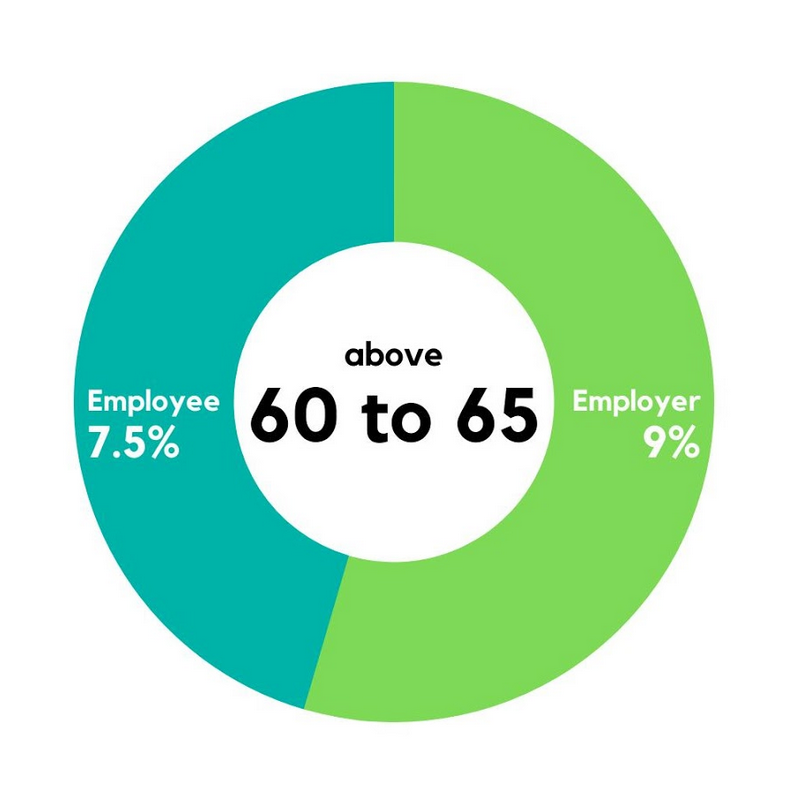

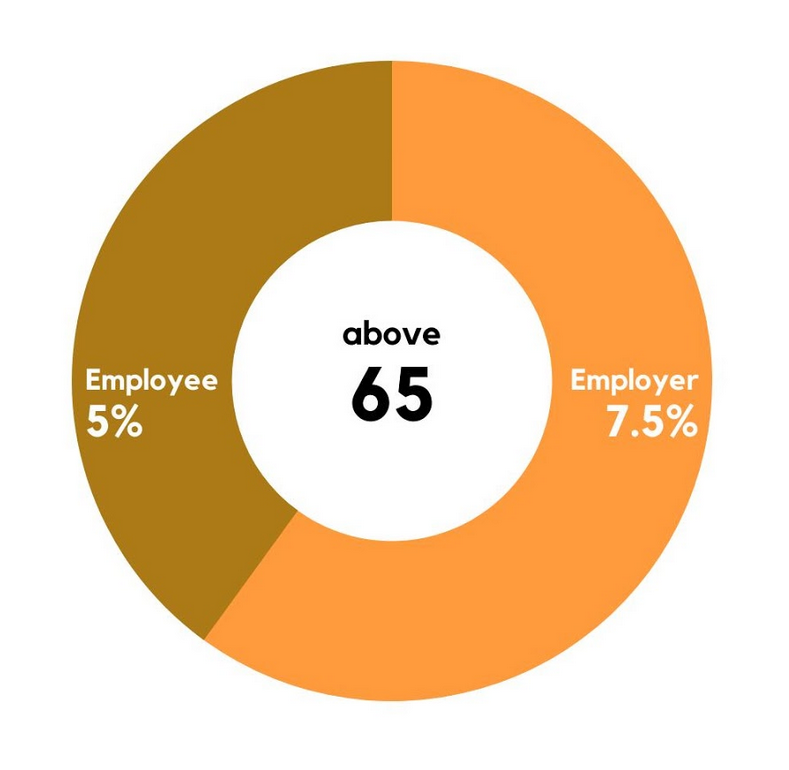

Both employers and employees will contribute into CPF

Contribution rates depends on age

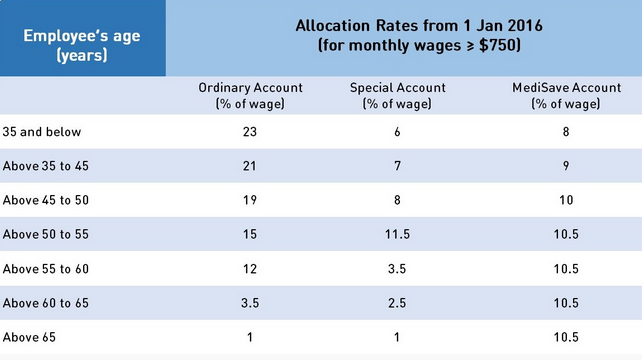

After being contributed to CPF, it is allocated into the 3 accounts

Allocation rates depends on age as well.

Funds are allocated to MA first, followed by SA and lastly OA.

Source: @Didyouknow_sg

How its Calculated

Example:

age 23

Employee salary = $2000

Sum allocated to MA = $2000 x 8% = $160

Sum allocated to SA = $2000 x 6% = $120

Sum allocated to OA = $2000 x 23% = $460

Total CPF contribution = $2000 x 37% = $740

Employee contribution = $2000 x 20% = $400

Employee take home pay = $1600

Refer to CPF board for more info.