Investing is the act of putting money into one/multiple financial instrument(s) with the expectation of receiving income and/or profits after some time.

How does it Make Money?

In general, most investors make money through

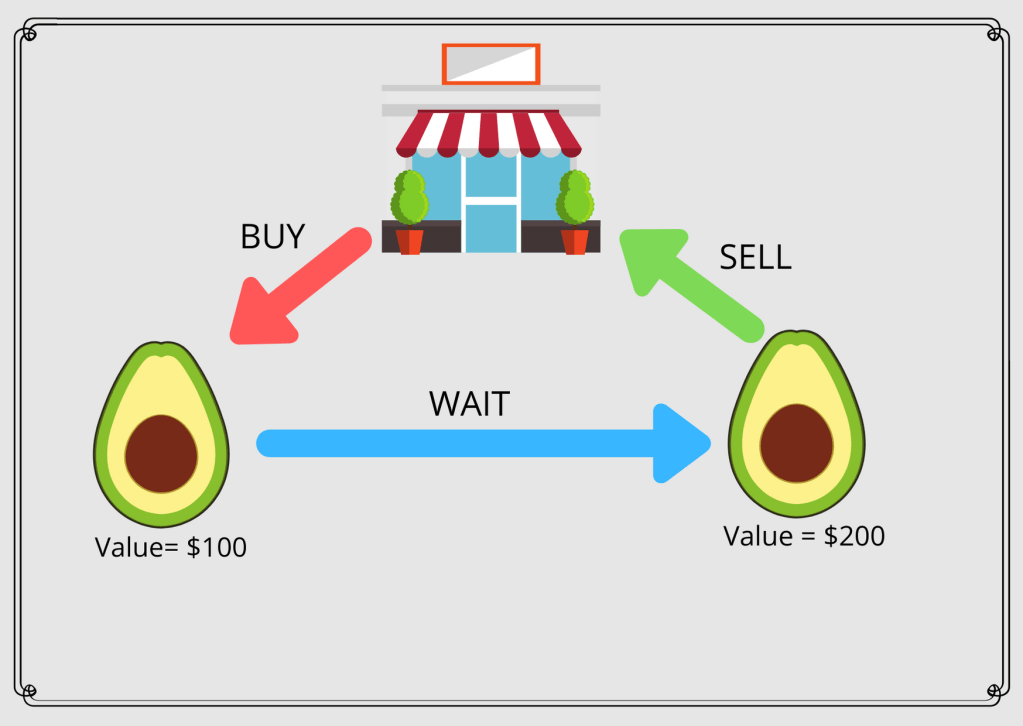

1) Appreciation

Appreciation refers to the increase of value of an asset.

Meaning to say, If you bought an item for $100 and 1 year later it is worth $200, then it is said to have been appreciated by $100.

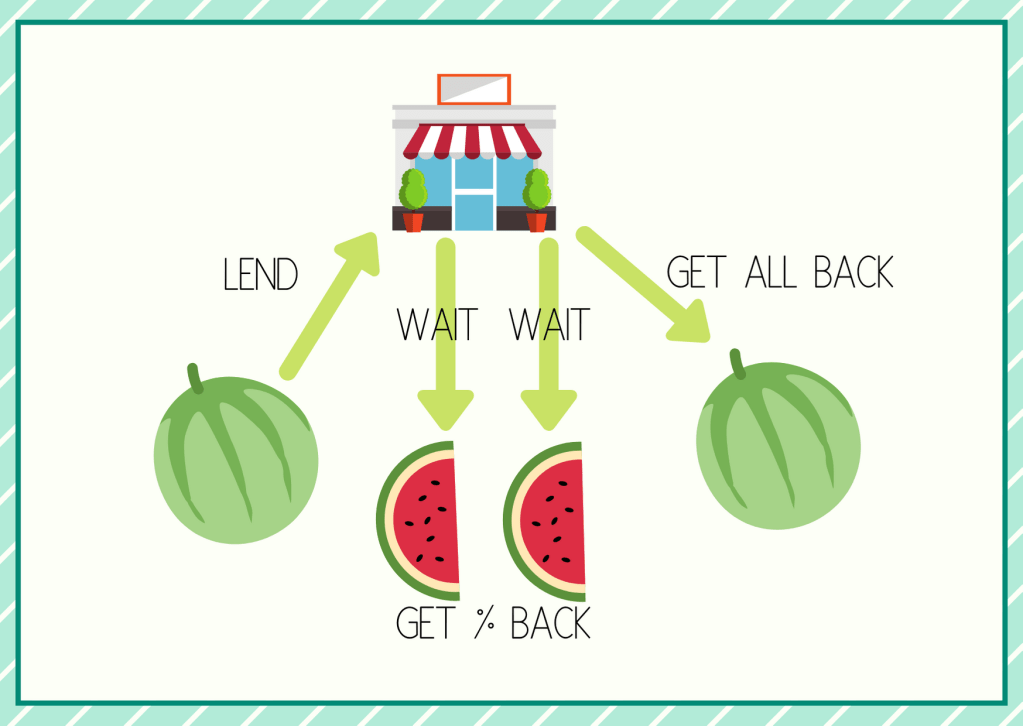

2) Interest payments

Interest payments, most commonly received from bonds, are regular payments received as a result from lending your money.

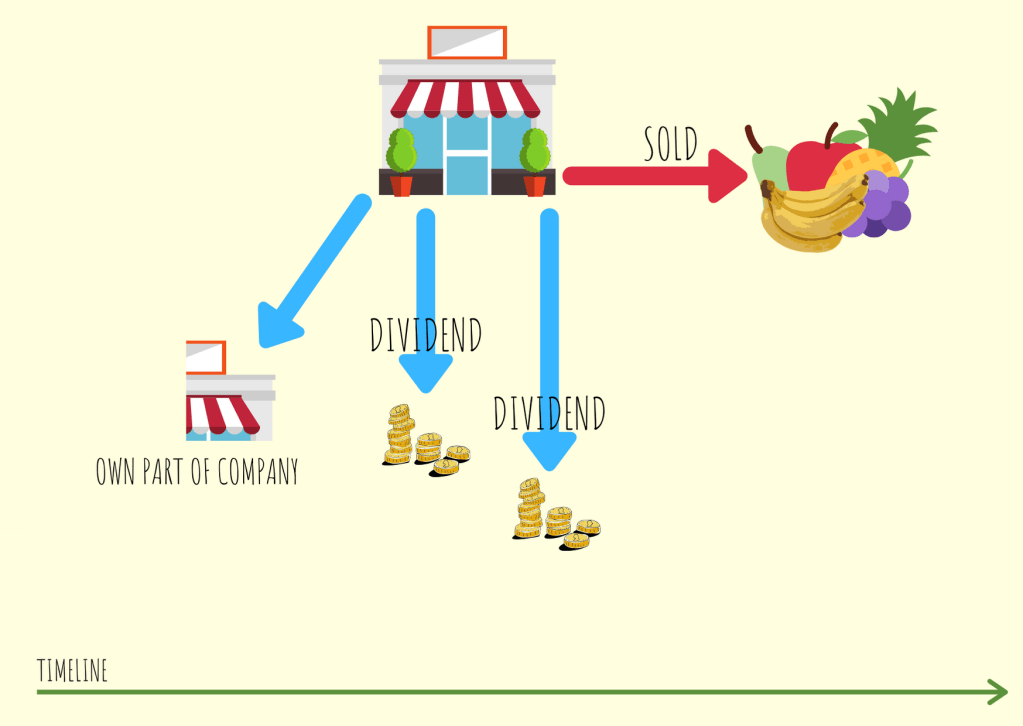

3) Dividends

Dividends are issued as a payment to investors, they are mainly from companies whose stock you own. However, not all stocks offer dividend payments.

Purpose of Investing

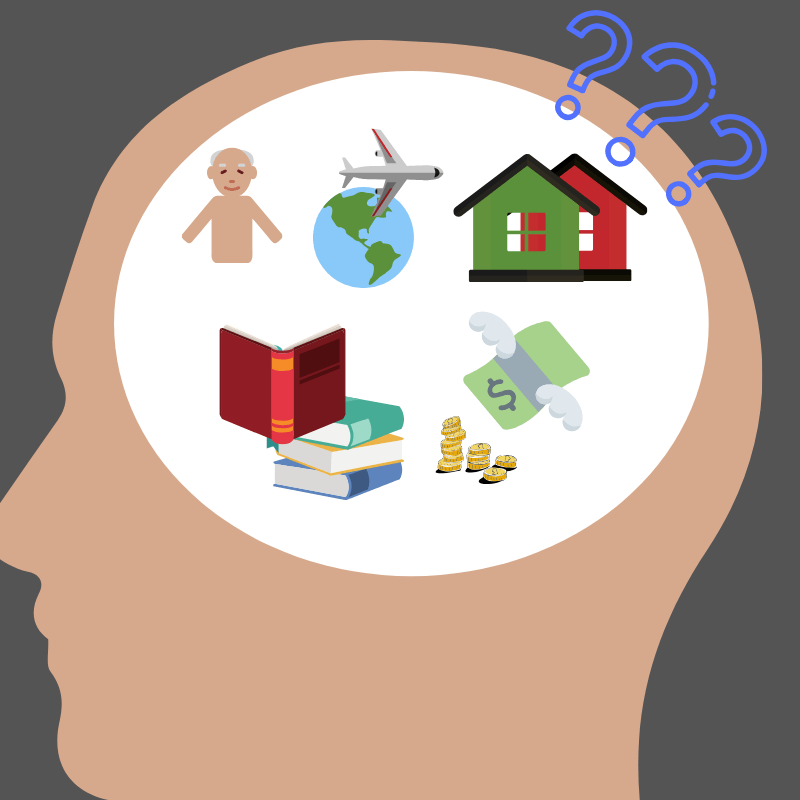

Every individual has one reason or another to start investing.

*It is important to always ask ourselves :

Why do you want to invest?

What are the things you want to achieve by investing?

The answers to these should be extra clear.

Reasons to Invest

1) For a better retirement

2) To meet short term financial goals

3) To meet medium term financial goals

4) To meet longer term financial goals

5) Create passive income

6) Beat inflation

Final Words

While investing is important, many do not take the time to study the subject due to family and work commitments. I truly believe that even when busy, some time should be spent on managing and making your money work harder for you.

After all, you spent many years accumulating them, and the choices you make or don’t make could cause you to lose your years of savings instead of growing your money.

We should all play an active role in our personal finances and not just leave it all to the professional advisors or fund managers.

This is your money, you take charge.