All investments involve some degree of risk.

Risks refers to the degree of uncertainty and/or potential losses as a result of a investment decision.

In general, the higher the risk, one would expect a higher reward and vice versa.

Business Risk

Business risk is related to the overall operation of a company.

Simply put, it is the possibility of a company to go out of business, due to multiple factors.

If a company goes bankrupt and its assets are liquidated, the company’s bondholders will be paid first, then holders of preferred stock , what’s left would be distributed to the common stockholders.

Volatility Risk

The stock price of a company may fluctuate up or down due to multiple reasons like political instability, problems arising from industrial/sector and internal company factors.

Inflation Risk

Inflation is a general upward movement of prices.

It reduces our purchasing power, therefore disadvantageous for investors receiving a low and fixed amount of interest.

Few concerns for individuals investing in cash equivalents is that inflation will diminish your returns.

Interest Rate Risk

Interest rate risk directly affects the value of bonds and indirectly affect many other investments. Therefore, affecting returns.

Liquidity Risk

Liquidity risk occurs when a business cannot meet its debt obligations.

Meaning, the entity is unable to convert an asset into cash without giving up capital and income due to an inefficient market.

Manage Investment Risks

Managing risk is key to a good investment strategy. There are 3 ways which are most commonly implemented.

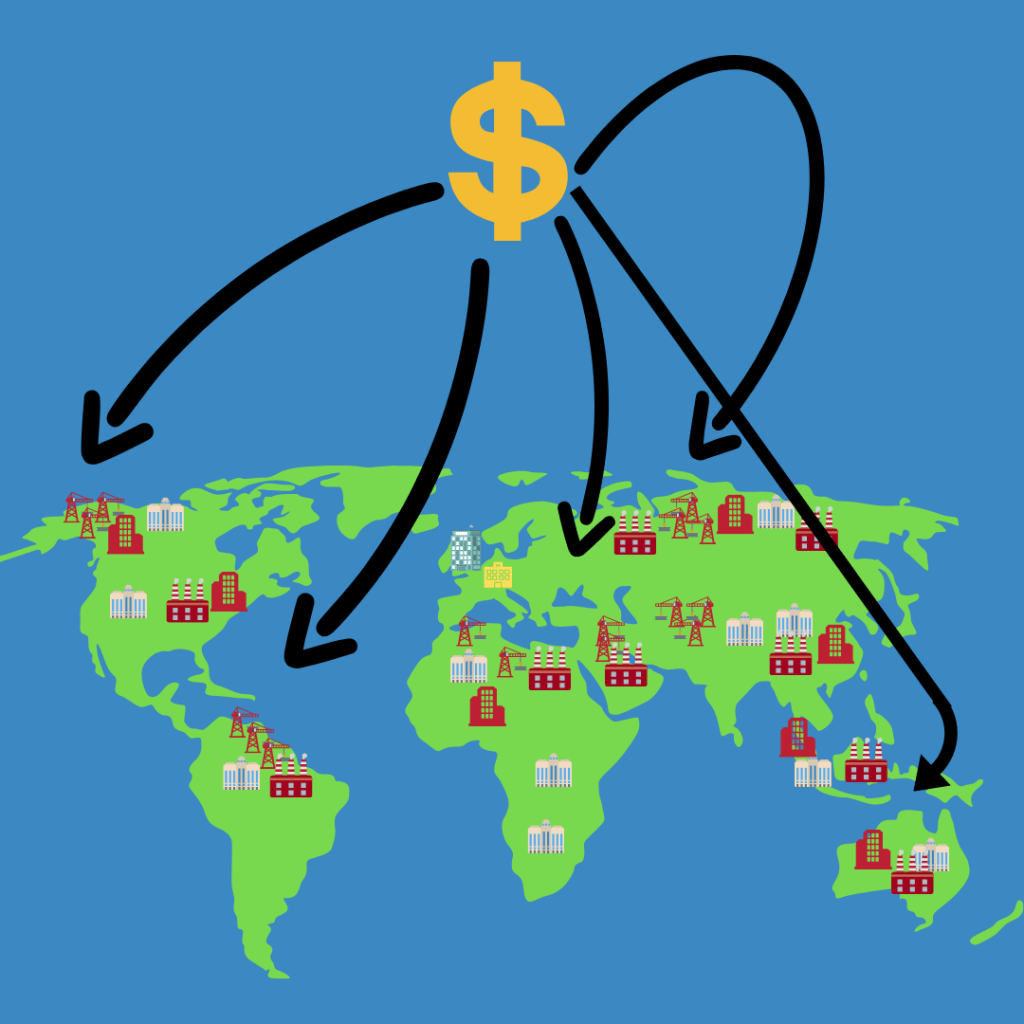

Diversification

One of the best ways to manage risk is to spread your savings and investments across a variety of channels.

Meaning, putting your money into different types of assets and investing in different securities within each type of asset class.

It also means spreading your investments across multiple sectors,countries etc for each asset class.

The reason for doing this is that, in the event that a single security or market sector takes a serious downturn, the chances of you incurring any substantial losses would be low.

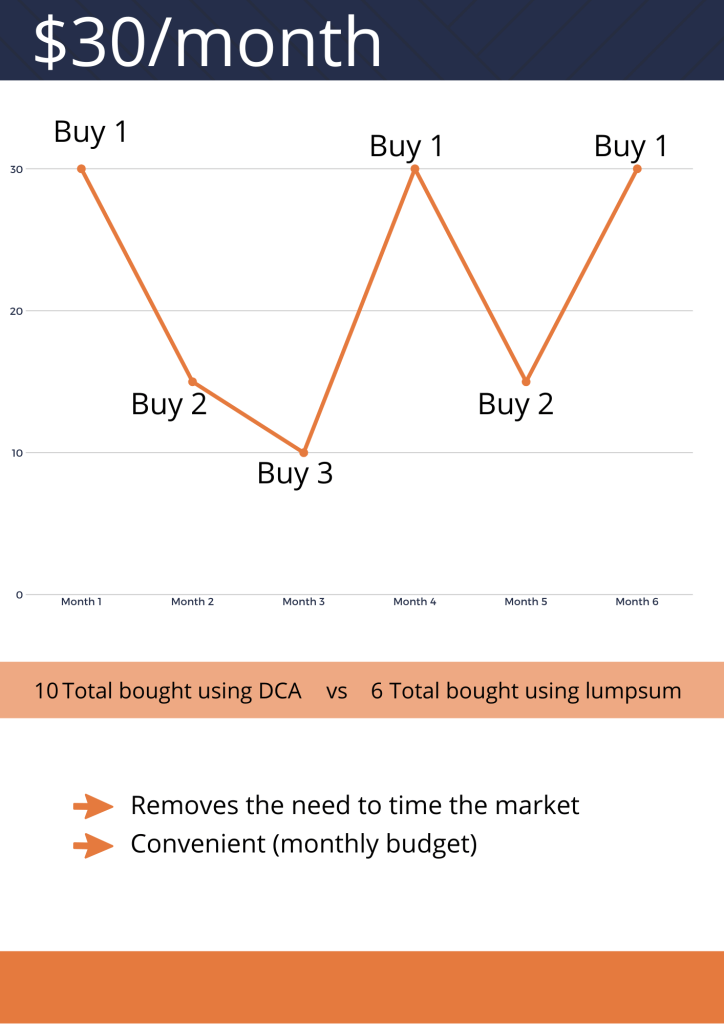

Dollar-cost averaging

The idea of DCA is to invest a fixed amount on a regular basis, regardless of price points.

This is to reduce the impact of volatility on the overall purchase price. By doing so, it removes the need to time the market.

Example:

Time in market

The MSCI World is a market cap weighted stock market index of stocks from companies throughout the world.

The index includes a collection of stocks of all the developed markets in the world, as defined by MSCI.

This includes securities from 23 countries but excludes stocks from emerging and frontier economies.

It is used as a common benchmark for global stock funds which gives a decent representation on how well the global markets are doing.

Research and historical data has shown that investing for the long term reduces investment risks because, even with price fluctuations over a short period of time, it generally will gain back any losses over the long term.

Conclusion

It is critical to understand the risks involved when investing. The investment decisions you make should always be based on a well thought out process.

A smart investor would always want to know :

What are the risks? How to minimize risks? How to reduce losses?

Whats the worse case? How much can you lose? Can you stomach the losses?

Do i need the funds for other purposes in the short term?

Are the gains worth the risk taken? (Efficient frontier)